We focus on just one thing, identifying and rectifying telecommunications taxes, surcharges, and regulatory fees on telecom bills.

We focus on just one thing, identifying and rectifying erroneous telecommunications taxes, surcharges, and regulatory fees on telecom bills. Our highly specialized telecom tax recovery team – composed of individuals with expertise in accounting, tax law, and telecommunications – identifies cost reductions, investigates over-billings, and champions successful resolution practices that result in substantial credits, refunds and savings.

Erroneous telecom tax reduction for the world's largest telecom spenders

Our typical engagement with a Fortune 100 company nets (post contingency fees) the client $3MM over three years.

Obtain user credentials from client to access in‐scope wireline telecom vendor(s) online billing platforms (e.g. AT&T BusinessDirect, Verizon Enterprise Center, CenturyLink Control Center)

Generate sampling of reports from each telecom vendor(s) online billing platform

Compile reports and begin in‐depth analysis of telecom taxes/fees/surcharges

Summarize quantified telecom tax/fee/surcharge reduction opportunities (e.g. prospective savings and/or credit/refund projections)

Present quantified telecom tax reduction opportunities to applicable client representatives via e‐mail

Discuss telecom tax reduction opportunities via conference call and assess which opportunity(ies) client wants to pursue

Compile draft disputes or refund claims and submit to client for comment or approval

Submit dispute/claims to telecom vendors/taxing authorities and obtain applicable tracking information (e.g. tracking, dispute numbers, refund claim numbers)

Ensure that telecom vendors/tax authorities have the necessary data to effectively analyze, suppress, approve and credit or refund erroneous taxes/fees/surcharges

Validate that erroneous taxes/fees/surcharges have been suppressed by telecom vendor(s)

Present client with credit/refund memos and validate credits/refund on invoices/refund checks

Aggregate telecom taxes/fees/surcharges and provide client with savings analyses (monthly, quarterly, bi‐annually, depending on terms of client engagement)

Ensure that suppressed taxes/fees/surcharges stay suppressed for term of client engagement

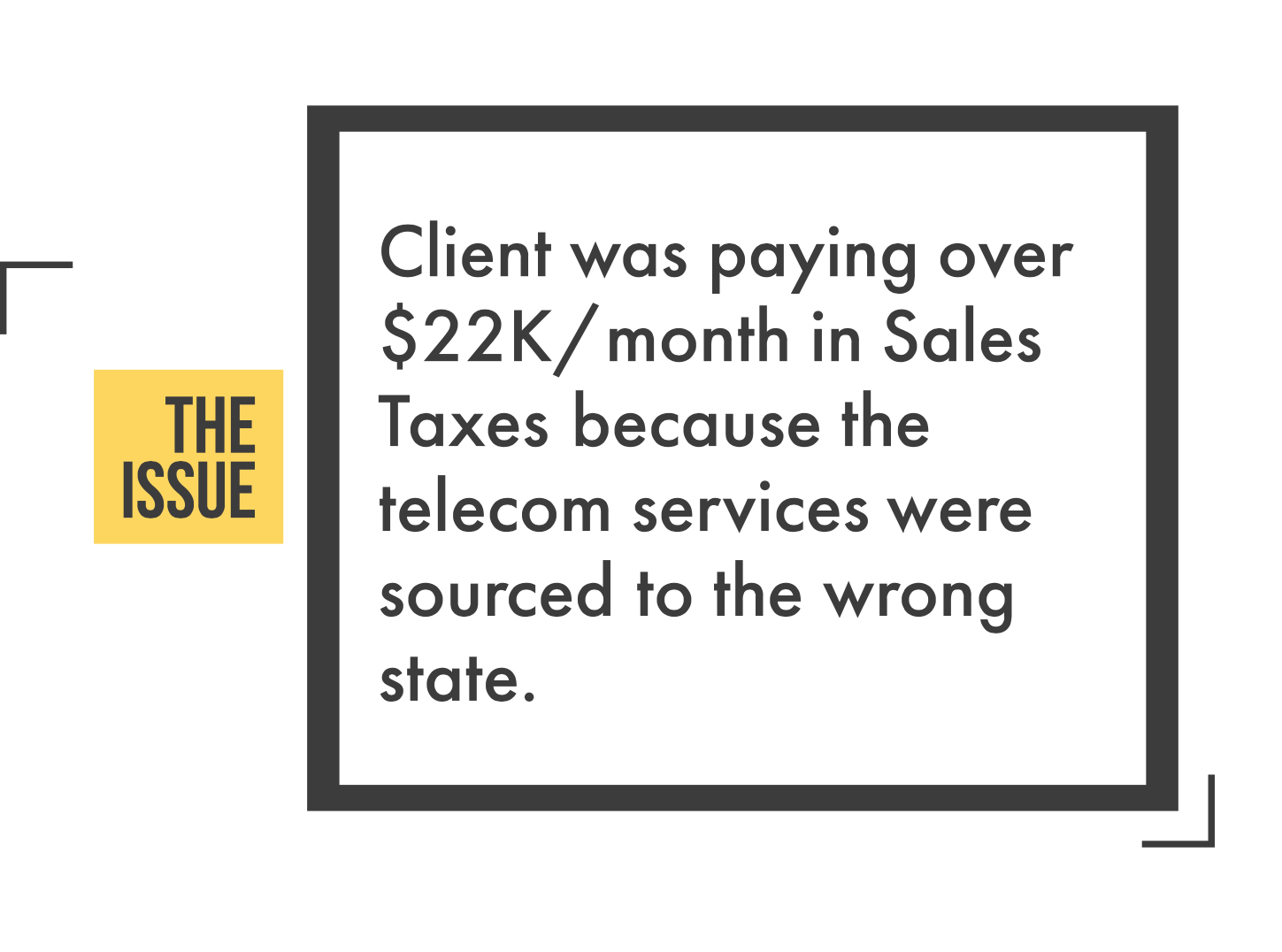

“Eliminated sales taxes entirely after properly sourcing the services. Average savings: $25k/mo. Credit Received $1.1.MM”

Or

Opportunity Associates, inc

Copyright © 2021. All rights reserved.